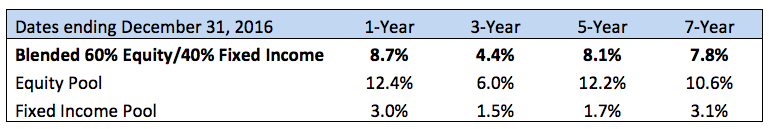

The Laguna Beach Community Foundation compiled 2016 gross performance figures for assets comprising their equity and fixed income pools. The equity pool, consisting of domestic and international holdings gained 12.4% for the year and the fixed income pool gained 3.0%. A blended portfolio of 60% equity and 40% fixed income, which is used for discretionary accounts, gained 8.7% for the year. Performance is calculated gross of fees and assumes monthly rebalancing to target weights and does not reflect cash holdings.

Jim Fletcher, chair of LBCF’s Investment Committee, commented, “Investment markets were strong throughout the year, however post-election fixed income sold off sharply as equities continued to gain. On the equity front, performance was dominated by domestic investments, with small caps rising over 20% and the S&P 500, a large cap domestic index, gaining 11.5%. On the fixed income side, high yield bonds gained 14.4% while our international holdings gained only 0.6% as the dollar strengthened in the latter part of the year. . We hold a mix of domestic and international equity and fixed income index funds. This gives us extremely broad diversification at a very low cost.”

The Laguna Beach Community Foundation pro bono Investment Committee has over 100 years of combined professional wealth advisory experience. By opening a Donor Advised Fund or a Nonprofit Charitable Fund with the Laguna Beach Community Foundation, you have access to these services at a minimal fee that directly goes back to supporting the services offered at the Community Foundation.

The Laguna Beach Community Foundation strengthens the community by encouraging philanthropy. LBCF provides expertise and resources to assist local charities, connect donor passions with non-profit needs, and work with local professional advisors to assist their clients in giving now and beyond their lifetimes with a legacy gift.

For more information, contact Laguna Beach Community Foundation at 949-715-8223, or mailto: info@lagunabeachcf.org